Why understanding the sequence of investment returns is so important

For investors, the order in which returns arrive can make the difference between success and failure.

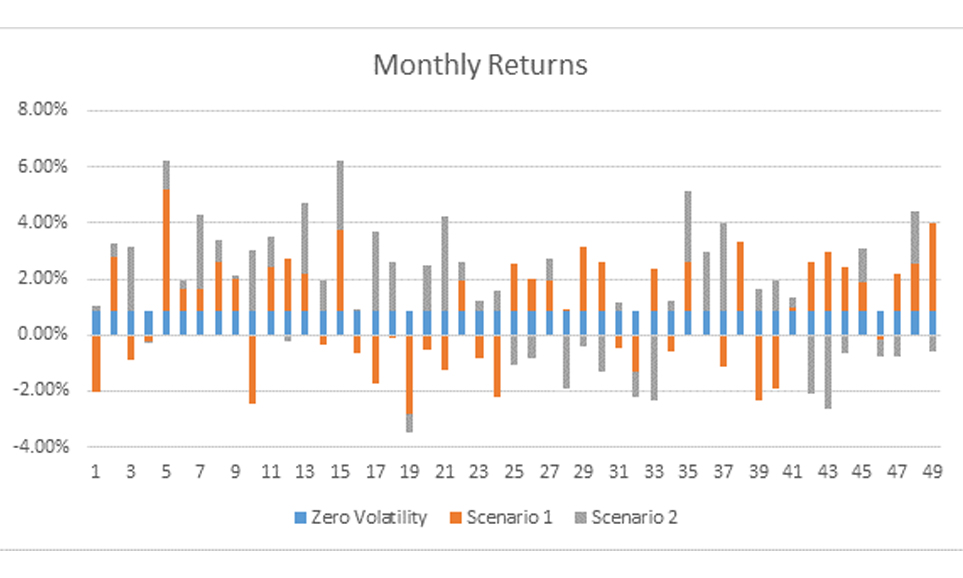

Imagine you are saving for 25 years (perhaps to help your children to buy a home). Let’s say you earn 25% in your best year; you lose 25% in your worst year; every other year you earn 5%. Now consider the running order of your investment returns. If the running order of your returns is Worst > Average > Best you will be better off than in the opposite situation, where the running order is Best > Average > Worst.

Does it really matter that much?

In the example above, the difference between the favourable sequence (worst year comes first) and the unfavourable sequence (worst year comes last) is over 50%. That could mean your children get much less financial help…and do not move out. So yes, it matters.

The last lap is the decider

For long term savers with a fixed time horizon, the final years are critical. The accumulated pot is typically at its highest value after years of contributions and compounded investment return. Recall that in the early years of saving the investment return is less important to wealth building than the annual contribution; however, as time passes, this situation turns around and investment returns are the main driver of final wealth. So, it is important to maximise the return in these critical late years without jeopardising the pot.

Growing and not shrinking

Market corrections happen; investment strategies come unstuck; tenants leave or go bust. Your investment strategy should be designed so that poor years would occur early, when the pot is still building up and there is time left to recover. You need to address sequencing risk, which in turn means thinking carefully about the sources of risk and return.

Different types of return

Total return from real estate comprises an income component and a capital value component. Over the long term the income return of stabilised assets has been higher than the capital component. The volatility of the income return has been much lower. This means that the risk adjusted return of the income component is superior over time.

Put another way, the cash flows arising from future capital gains are less certain than income, so you can handle sequencing risk better by placing greater reliance on income as opposed to capital growth to achieve a target return. Strategies that are heavily reliant on capital returns to meet their return target are more likely to endanger the accumulated savings.

Nothing going on but the rent

As your time horizon starts to shorten, make sure your portfolio is driven by income rather than capital values. Here are some useful tips:

1. Avoid strategies whose target returns significantly exceed initial yield. These strategies bring with them a wide range of possible outcomes and higher exposure to sequencing risk.

2. When considering sequencing risk think about income returns and capital returns as if they were separate asset classes.

3. Try not to focus on sector, geographic and style labels but aim to understand the reliability of the portfolio’s rental income. Consider the credit worthiness of the top tenants. If their combined credit worthiness were rated like a bond, would that bond be investment grade (BBB or higher) or not?

On this last point, the new proptech firm Income Analytics provides an equivalent bond rating specifically for the commercial real estate market.

Save the last dance for me

For long term investors in real estate, the sequence in which returns occur can make the difference between a successful strategy and a failure. At Didobi, we help clients to identify the sequencing risks that lurk behind bland labels such as “core”.

The last lap is critical – get it right by focusing on reliable rental income.

Leave a comment: